Wise is a powerful remittance product. Many users even treat it as a multinational bank.

Wise Features

Wise has three features:

- Remittances.

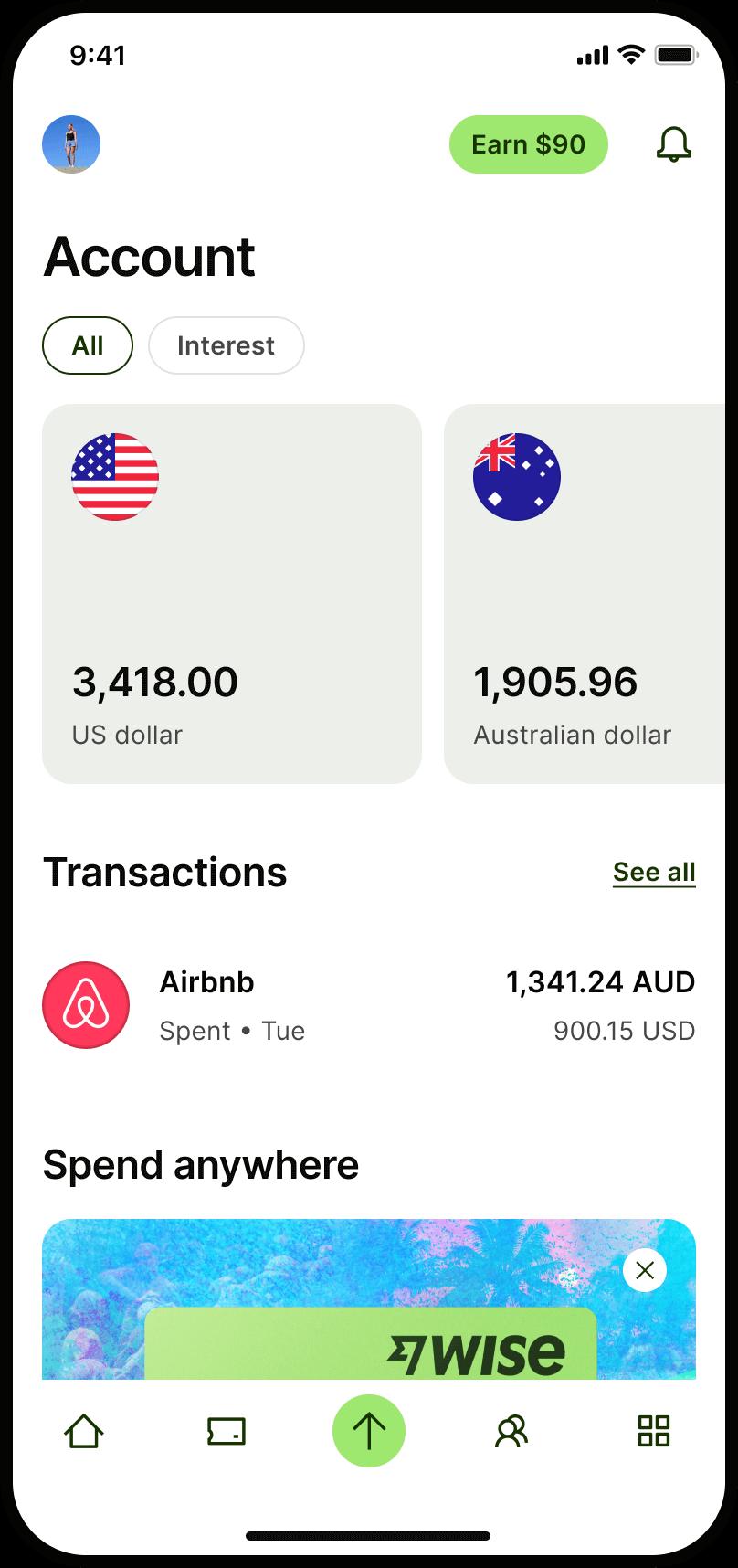

- Multi-currency accounts.

- Wise card.

Remittance is the transfer of money from one country to another. It’s faster than traditional wire transfers, but there are fees.

Multi-currency accounts: some currencies have bank receiving information, which means that there is a local account in each corresponding country for you to use. Opening a Wise multi-currency account is equivalent to opening bank accounts in many countries. However, the difference from banks is that there are no counter service personnel and no deposit insurance.

Wise card withdrawals are free worldwide within the limit. Of course, the issuing bank fee is waived, but ATMs may charge fees (this is common knowledge).

Wise supports up to 3 virtual cards + 2 physical cards (1 white and 1 green, unique to the UK region), for a total of 5 cards. Frequent address changes will require proof of address.

Note,

Wise is not a bank.

WISE is not a bank.

Wise is not a bank.

Don’t put too much money in it, otherwise you will be asked to provide more proof. It’s not a bank, and there’s no deposit insurance.

Generally, transfer as much money as you need.

Click here to join the communication group and get the latest information

HSBC has launched a competitor to Wise called Zing: Zing Registration Tutorial

Wise Regions

Wise differs in different regions:

Mainland China, Hong Kong, and Taiwan do not offer cards

Hong Kong does not have multi-currency accounts or cards, and can only remit money

The UK can get two physical cards, 1 white and 1 green, unique to the UK region, and can open virtual cards.

US cards must be used in the US to be activated.

Wise cards issued in Japan cannot be added to Google Pay and Apple Pay yet.

Malaysia can only be activated by Malaysian bank transfers, but only this region has a Malaysian receiving account. You can open it in another region, not take the card, and transfer it here. Opening a Wise MY MYR account may trigger Wise to ask for proof of address or proof of income. If you want to open one, you can choose to register in the UK or CA at the beginning, and after activation, don’t take the card and immediately transfer it to Malaysia, and only take the Malaysian card (generally, the first address change will not require proof of address, because you did not take the card. Generally, the 3rd card is required. If you are really asked for it for the first time, then first use Yoodo to open a Bigpay, and transfer it to MY Wise after one or two months of having transactions)

It is recommended to open in a region where you can provide proof of address. If you want a card but cannot provide proof of address, Canada is recommended.

If the area you open cannot provide proof of address, please be careful when transferring funds.

If it is for transfers, for the safety of funds, please open a Wise account in your region where you can provide proof of address.

To change regions, you need to provide proof of address, see the instructions below.

Registration

WISE registration does not require any KYC documents, and using WISE also does not require documents in most cases, only in some cases

Registration is not IP restricted

Enter your email, QQ email is not recommended

Supports 1 primary mobile number and 1 backup mobile number. There are no requirements for mobile numbers, any common region, virtual number is also OK, +86 is also OK.

Select the country of residence (UK, Canada, Singapore, Malaysia are recommended if you have corresponding proof of address.). It is recommended to choose the UK or Canada.

Enter passport information and residential address information (residential address determines which region’s Wise the account belongs to)

The mailing address for the card is not related to the residential address, and can be filled out separately when applying for the card. See the introduction later for applying for the card.

One passport can only register one account, please select the region where you live. You can change the region, but you need documentary materials.

Select a currency account to get account details and make the first deposit to activate Wise

If the address is in mainland China, basically only a mainland ID card or driver’s license can solve it, and a passport is required in a few cases

If the document photo cannot be recognized by the machine, please take a photo with the mobile phone web version and try a few more times

If it is a non-mainland China region, you cannot use a mainland China ID card or driver’s license, you need a mainland China passport and other documents

For mainland China region, proof of address is generally not required, even if it is required, the difficulty is very low, mainland China region users can change their address at any time (including country, but may require proof), overseas often requires proof of address

A bank statement is sufficient for proof of address, which is not difficult, but it does not rule out the need for a tax number (especially the United States)

Deposit Activation

Generally, activation refers to opening a WISE borderless multi-currency account (mainly USD, GBP, EUR)

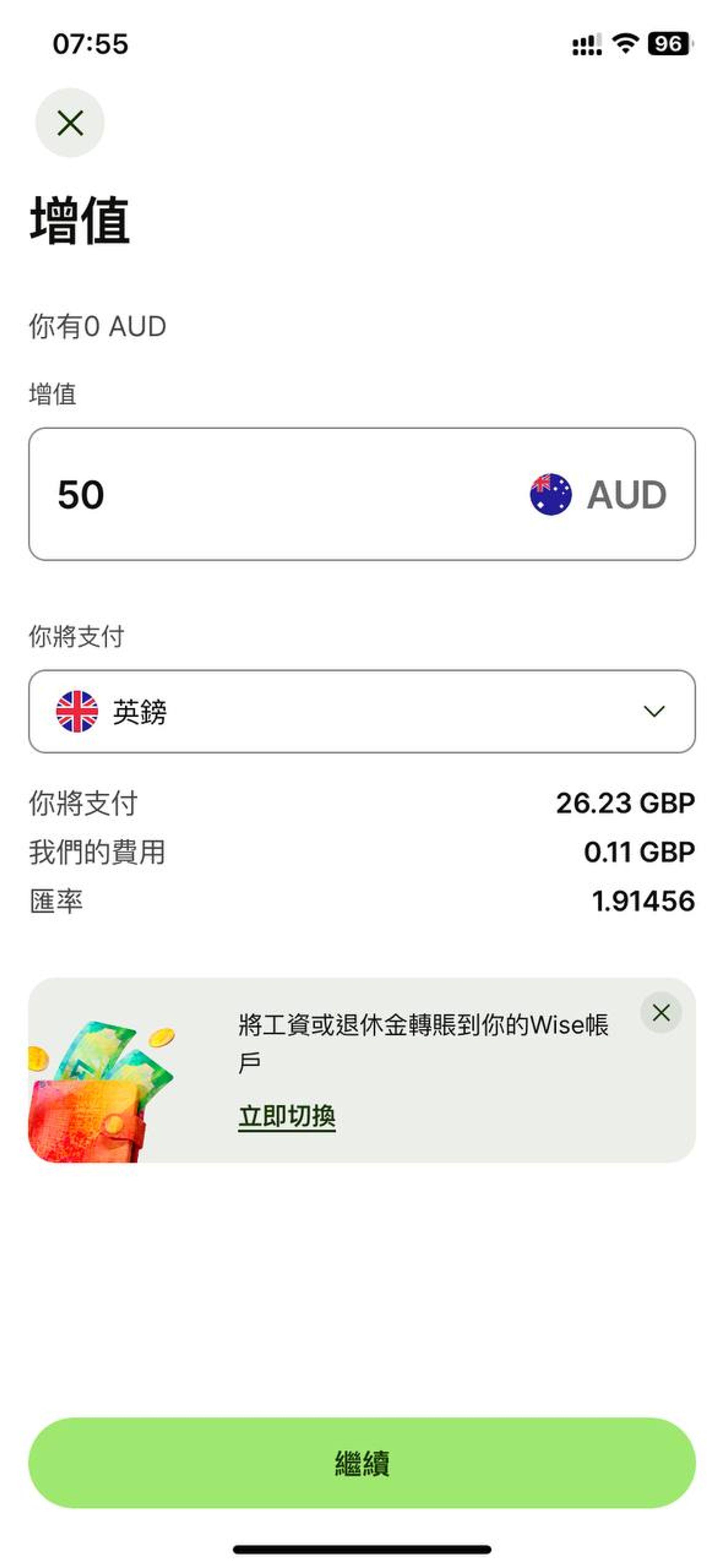

The deposit for activating a personal account is the first top-up, which will be credited to your balance

Activation/Deposit methods:

- Activate with a non-mainland China credit card/debit card

- Domestic bank wire transfer activation (high fees, slow arrival)

- Other methods of remittance activation

Here are some recommended deposit methods:

Bank of China Deposit

You need a Bank of China mainland Class I card and a registered Bank of China mobile bank.

BOC transfer to WISE GBP has no intermediary bank, which means that with a coupon, it’s free

Remittance of 30 CAD, Wise fee 0.02 CAD

First, go to download “Bank of China Cross-border GO”, log in, bind the card, and complete real-name authentication. Click on the poster on the homepage to receive a 500 CNY coupon.

If you don’t have a coupon, don’t use this method, remittance costs 120 CNY or more per transaction.

Go to Wise to initiate a transfer, it doesn’t matter what currency you want to increase (i.e. the currency above), but the payment currency must be GBP.

Because before activation, only GBP gives a personal account, other accounts are Wise’s public account, and it is impossible to wire transfer to a public account from abroad.

Note that the name of the payee you are remitting to is your name. If not, please do not remit.

Bank of China mobile bank, purchase the corresponding amount of GBP foreign exchange (because you don’t need to withdraw cash, remittance is much cheaper than cash)

Then fill in the receiving information into BOC remittance.

Remember to write the remarks, how does Wise know who this money is for if you don’t write the remarks?

After sending it out, if no Bank of China staff calls you, it is generally fine, and then you can slowly wait for the money to arrive.

Hong Kong Bank FPS Deposit

If you have a Hong Kong bank, deposit is cheap and convenient.

When depositing, Wise’s receiving and your payment currency both choose HKD to have the FPS option, the deposit fee is 0 (please read Basic Knowledge of Bank Accounts and Bank Cards in Hong Kong for the Faster Payment System FPS part.)

After selecting FPS, click OK, and Wise’s FPS receiving information and remarks will appear. These remarks are very important, be sure to fill in the remarks when transferring, otherwise WISE may receive the funds but not credit them to your account.

But in most cases, you will exchange other currencies for use after your free deposit.

Click here to view the method of transferring money from mainland China to Hong Kong for free, to achieve China’s bank > Hong Kong’s bank > Wise, all fees are waived

There are many pitfalls in the actual use of Hong Kong Faster Payment System FPS, please see Detailed Usage Guide for Hong Kong Bank Faster Payment System FPS to Avoid Mistakes

TNG Low Exchange Rate Deposit

Malaysia Wise provides an exclusive MYR receiving account. You can use TNG to purchase a PIN code, and then convert the PIN code into a transferable balance for only 1% fee, and then transfer it to Wise’s MYR receiving account. The arrival is fast, the same name is relatively safe, and the fee rate is low.

Apply for Wise Card

If the Wise region you registered in can apply for a card, you can fill in any address in the world to receive the card, as long as it is a normal region. Ordinary mail in China may not be received.

Wise cards are good, but there are no cashbacks for swiping. Click here to view the comparison of cashback policies for overseas transactions of Chinese bank cards in 2024

Change Wise Region

- If you want to switch to Malaysia, you can use Bigpay as proof of address

- If you want to switch to Singapore, you can use OCBC as proof of address

- If you want to switch to the EU, you can use N26/vivid as proof of address

- If you want to switch to Australia, you can use HSBC AU as proof of address

- If you want to switch to the UK, you can use Chase UK/Monzo as proof of address

Click here to join the communication group and get the latest information

HSBC has launched a competitor to Wise called Zing: